Japanese technology investment group SoftBank has divested its entire $5.8 billion stake in chipmaker Nvidia, according to its latest quarterly earnings report. The move is designed to free up capital for the company's ambitious and costly investments in the artificial intelligence sector, including a significant commitment to OpenAI.

Key Takeaways

- SoftBank sold its complete holdings in Nvidia, valued at $5.8 billion, in October.

- The primary reason for the sale is to finance a $30 billion investment in OpenAI.

- Company executives stated the decision was a practical financial move, not a reflection on Nvidia's performance.

- This is the second time SoftBank has sold a major Nvidia stake, having previously divested in 2019 before the stock's significant rise.

A Strategic Pivot to AI

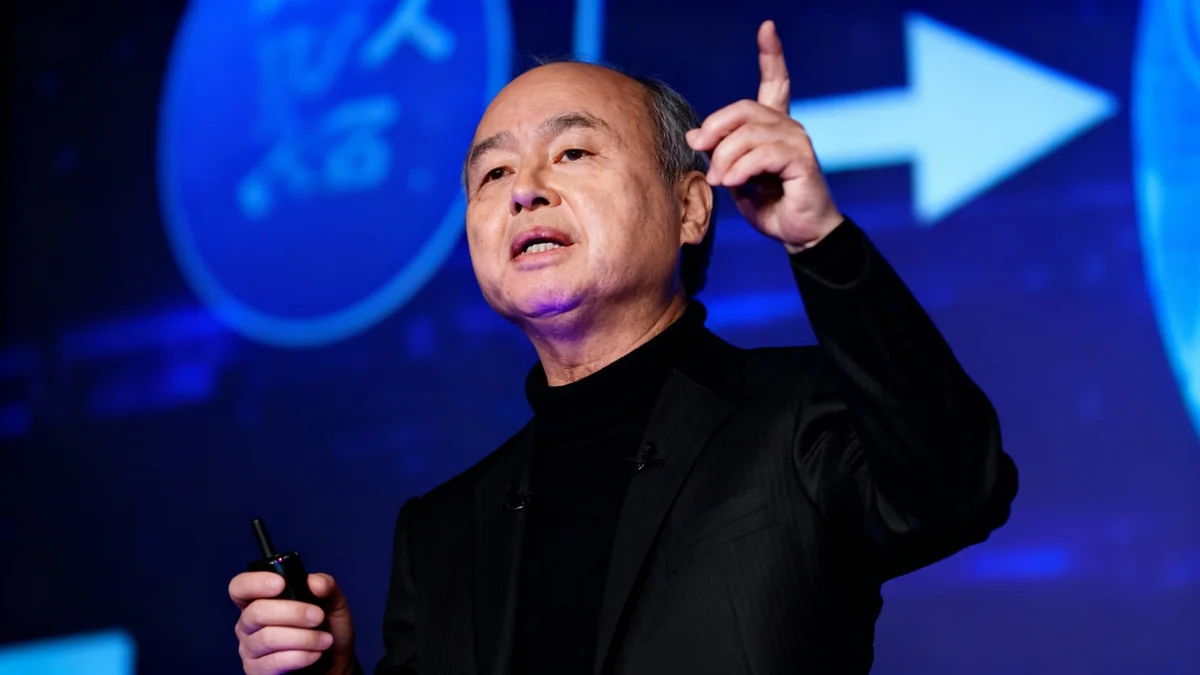

SoftBank is repositioning its portfolio to double down on what its founder, Masayoshi Son, has called the "A.I. revolution." The sale of its Nvidia shares is a direct consequence of this strategy, providing the necessary liquidity for massive capital outlays in emerging AI companies.

The centerpiece of this strategy is a $30 billion investment in OpenAI, the company behind the widely used ChatGPT platform. This commitment was finalized following OpenAI's recent corporate reorganization into a for-profit entity, a move that paved the way for large-scale external investments.

Context: OpenAI's New Structure

Late last month, OpenAI completed a significant restructuring to become a for-profit company. This change was crucial for attracting the massive capital needed for its research and infrastructure development, enabling deals like the one with SoftBank.

During a call with analysts, SoftBank's Chief Financial Officer, Yoshimitsu Goto, emphasized that the sale was a matter of financial logistics rather than a vote of no confidence in Nvidia.

"We do need to divest our existing portfolio so that, that can be utilized for our financing," Goto explained. "It’s nothing to do with Nvidia itself."

Financing an Ambitious Vision

The OpenAI deal is just one part of a much larger investment plan. SoftBank has publicly announced its intention to invest approximately $100 billion in various AI-related projects within the United States. This aggressive push requires the company to actively manage its assets, which includes selling profitable holdings and taking on significant debt.

Another major initiative is the venture known as Stargate, a collaboration between SoftBank, OpenAI, and Oracle. The project aims to construct a vast network of data centers specifically designed to power next-generation artificial intelligence models.

Circular Investments in AI

The tech industry is seeing a trend of circular investments, where companies invest in each other to fuel growth. For example, Nvidia has committed up to $100 billion to OpenAI, which in turn will use the funds to purchase Nvidia's advanced processors for its data centers.

These large-scale commitments underscore the immense financial resources required to compete at the highest level of AI development, forcing even giants like SoftBank to make difficult choices about their existing investments.

Market Reacts with Caution

News of the sale by an influential investor like SoftBank has created ripples in the market. Some analysts and investors see it as a potential signal that the meteoric rise of AI-related stocks could be reaching a peak, stoking fears of an overinflated bubble.

These concerns were amplified by recent social media commentary from Michael Burry, the hedge fund manager known for predicting the 2008 financial crisis. Burry publicly questioned the accounting practices of tech companies making enormous purchases of computer chips, adding to a growing sense of skepticism among some market watchers.

Despite the market's unease, SoftBank's immediate financial results have been positive. The soaring valuation of its stake in OpenAI helped the company more than double its profit in the most recent quarter, reaching 2.5 trillion yen, or $16.2 billion, on paper.

A Familiar Story for SoftBank and Nvidia

This is not the first time SoftBank has parted with a significant position in Nvidia. The investment group sold a previous stake in the chipmaker back in 2019, just a few years before Nvidia's stock value exploded due to the unprecedented demand for its AI-powering processors.

That earlier sale is now viewed as a missed opportunity for substantial gains. The memory of that decision raises the stakes for SoftBank's current strategy. By selling Nvidia now to fund OpenAI, the company is making a calculated bet that the future returns from foundational AI models will ultimately surpass the continued growth of the hardware that powers them.

The success of this high-stakes financial maneuver will depend entirely on whether SoftBank's vision for an AI-centric future, led by companies like OpenAI, comes to fruition.