Tech giant Nvidia has marked a significant achievement, briefly surpassing a $5 trillion valuation in October. This milestone highlights the company's central role in the expanding artificial intelligence industry, driven by strong demand for its specialized chips. The firm's stock has seen remarkable growth since late 2022.

Nvidia's success is deeply connected to the global push for AI development. Its Graphics Processing Units (GPUs), initially designed for gaming, have become essential for training complex AI models. This shift has transformed the company's market position and financial outlook.

Key Takeaways

- Nvidia briefly exceeded a $5 trillion valuation in October, a first for any company.

- The company holds an 81% market share in data center AI chips.

- Nvidia's stock has surged 12-fold since the launch of OpenAI's ChatGPT in November 2022.

- New Vera Rubin chips are expected to drive future growth, with projected sales of $500 billion by 2026.

- Challenges include competition, market bubble concerns, and US export restrictions to China.

Nvidia's Dominance in AI Chip Market

Nvidia's market share in data center AI chips stands at an impressive 81% by revenue. This figure, according to research from the International Data Corporation, underscores the company's near-monopoly in a critical sector. Global companies are showing insatiable demand for these specialized components.

The company's stock, NVDA, has experienced an extraordinary surge. It climbed 12-fold since OpenAI released its ChatGPT AI chatbot in November 2022. This event is widely seen as the catalyst for the current AI boom, propelling Nvidia into a new era of growth.

Fast Facts

- Founded in 1993, initially focusing on GPUs for video games.

- Reached $1 trillion valuation in 2023, three decades after its establishment.

- Sales and profits increased over 60% in the October quarter year-over-year.

Nvidia's financial performance has consistently exceeded expectations. In the October quarter, its sales and profits rose by more than 60% compared to the previous year. This robust growth reflects the ongoing high demand for its products and solutions.

Strategic Innovations and Future Growth

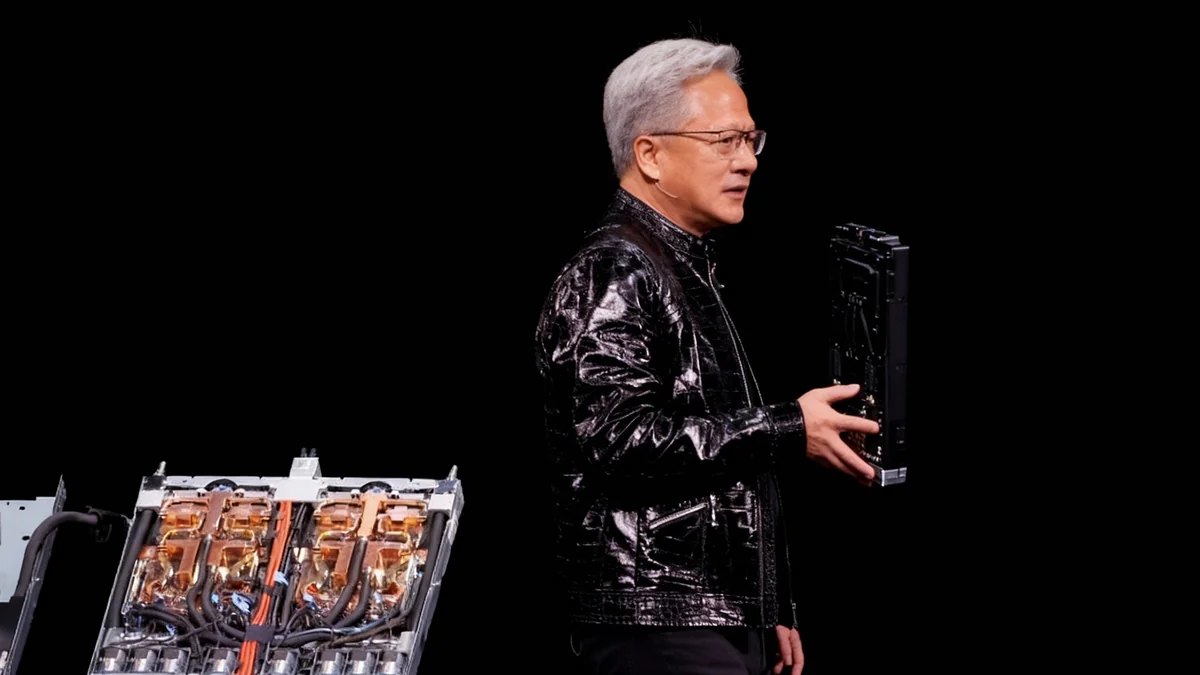

Beyond GPUs, Nvidia offers a comprehensive ecosystem of hardware and software. This includes full server racks packed with various chips essential for AI workloads. The company also provides software that allows developers to optimize their code for Nvidia's chips, creating a powerful integrated solution.

"Our vision is that, someday, every single car, every single truck will be autonomous," Nvidia CEO Jensen Huang stated, highlighting the company's broad ambitions.

Nvidia recently unveiled its next-generation Vera Rubin chip. This new chip is widely viewed as the company's next major growth driver. Production is currently underway, with initial deployments expected in the second half of 2026 by major cloud providers such as Microsoft, Amazon Web Services, Google Cloud, and CoreWeave.

Building AI Factories

Nvidia is laying the groundwork for what it calls "AI factories" – advanced data centers designed for future AI needs. This strategic move aims to position the company at the heart of emerging technologies like robotics, quantum computing, and self-driving cars. Partnerships with Uber for self-driving cars and the US Department of Energy for quantum supercomputers underscore these efforts.

The company projects total sales to reach new records in 2026, with revenue estimates around $500 billion. This ambitious forecast reflects Nvidia's confidence in its continued innovation and market expansion.

Global Ambitions and Emerging Challenges

Nvidia's chips have become fundamental to the global AI industry, leading to expanded partnerships across continents. In Europe, the company collaborates with telecommunications firms and governments in France, Germany, Italy, and the United Kingdom. These partnerships focus on deploying sovereign AI infrastructure and establishing AI technology centers.

In South Korea, Nvidia is working with government and businesses to deploy over 26,000 chips. These international collaborations demonstrate the global reach and impact of Nvidia's technology.

Despite its rapid growth, Nvidia faces several challenges. Intensifying competition from rivals like AMD is a significant concern. Additionally, some customers are developing their own chips to reduce reliance on a single dominant supplier. There are also lingering market concerns about a potential AI bubble, though CEO Jensen Huang has repeatedly dismissed these worries.

- Competition: Rivals like AMD are increasing their focus on AI chips.

- Customer Dependence: Major tech firms are exploring in-house chip development.

- Market Bubble: Concerns about an AI market bubble persist among some analysts.

Another major hurdle is US tech controls, which have restricted exports of Nvidia's cutting-edge chips to China. China was once a significant market for Nvidia, and these restrictions have impacted sales in the world's second-largest economy. While efforts have been made to reverse some restrictions, the situation remains fluid.

Nvidia's diversification strategy extends beyond data centers. Huang has also introduced new AI models for autonomous driving and robotics. This deepens the company's push to become a major player in these fields, aligning with his vision of a future dominated by autonomous vehicles.