Amazon has announced a plan to invest $200 billion in capital expenditures in 2026, primarily focused on artificial intelligence and robotics. The announcement followed the company's fourth-quarter earnings report, which showed significant revenue growth, and came just one day after The Washington Post, owned by Amazon founder Jeff Bezos, confirmed it was laying off approximately one-third of its employees.

Key Takeaways

- Amazon plans to increase capital spending to $200 billion in 2026, a significant jump from $125 billion, to fund AI, robotics, chips, and satellite projects.

- The company reported fourth-quarter revenue of $213.4 billion, a 14% increase year-over-year.

- Amazon Web Services (AWS) saw its fastest growth in 13 quarters, with revenue climbing 24% to $35.6 billion.

- The investment news contrasts with major layoffs at The Washington Post, which is privately owned by Amazon's executive chair, Jeff Bezos.

The Multi-Billion Dollar Push into AI

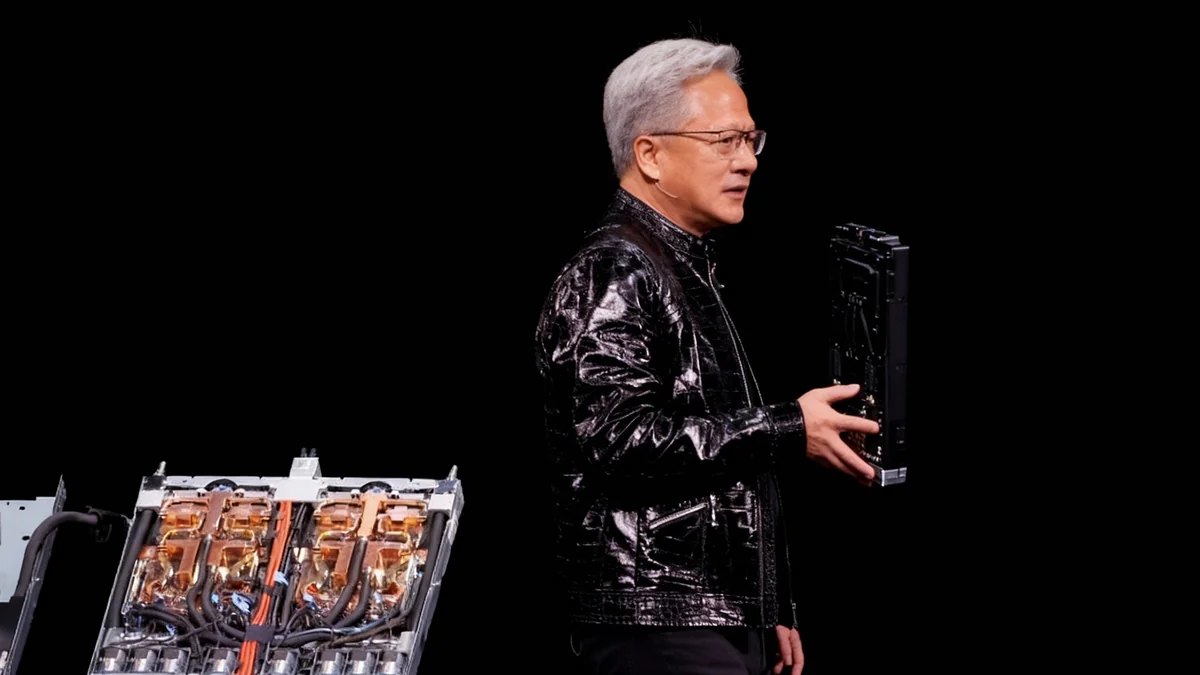

Amazon is dramatically increasing its investment in future technologies, signaling a firm commitment to leading the ongoing AI arms race. The company's plan to spend $200 billion on capital expenditures in 2026 marks a substantial increase from its current spending levels and surpasses previous Wall Street expectations of around $147 billion.

In a press release, CEO Andy Jassy outlined the strategic focus of this massive investment. He cited strong demand for existing products and significant opportunities in emerging fields as the primary drivers for the spending increase. The funds are earmarked for several key areas, including artificial intelligence, proprietary chip development, advanced robotics, and the company's low earth orbit satellite initiative.

Tech Giants' Collective Spending

The scale of investment in AI is industry-wide. Amazon, Microsoft, Google's parent company Alphabet, and Meta are collectively projected to spend more than $630 billion this year on technology infrastructure and development.

This move positions Amazon to compete aggressively with other tech titans who are also pouring billions into generative AI and related infrastructure. The goal is to build and control the next generation of computing power, which is seen as essential for future growth across cloud services, e-commerce, and new business ventures.

Robust Financial Performance

The investment announcement was supported by a strong financial report for the fourth quarter of fiscal year 2025. Amazon's revenue grew by 14%, reaching $213.4 billion for the three-month period ending December 31. This compares to $187.8 billion in the same period a year ago.

Net income for the quarter was reported at $21.2 billion, or $1.95 per share. While this was slightly below the analyst consensus of $1.97 per share, the overall growth trajectory remained positive. The company's stock, however, saw a decline of nearly 9% in after-hours trading following the earnings release.

AWS and Advertising Drive Growth

A significant highlight of the earnings report was the performance of Amazon Web Services (AWS), the company's cloud computing division. AWS recorded its fastest growth in 13 quarters, with revenue increasing by an impressive 24% to $35.6 billion. This indicates strong and accelerating demand for cloud services, which are foundational for AI development.

The company's advertising business also showed robust health, with revenue climbing 22% during the quarter. These two segments, AWS and advertising, continue to be powerful engines for Amazon's overall financial performance and provide the capital necessary for ambitious long-term investments.

A Tale of Two Companies

The timing of Amazon's massive investment plan has drawn considerable attention due to its proximity to events at The Washington Post. The newspaper, which Jeff Bezos purchased for $250 million in 2013, announced it was cutting its workforce by approximately one-third just one day before Amazon revealed its spending plans.

Bezos's Dual Roles

Jeff Bezos founded Amazon in 1994 and served as its CEO for nearly three decades before transitioning to the role of executive chair in 2021. The majority of his estimated $235 billion net worth is composed of Amazon stock. His ownership of The Washington Post is a separate, personal investment.

The layoffs at the Post have fueled concerns about the future of the storied news organization. The contrast between the hundreds of billions being allocated for technological expansion at Amazon and the deep cuts at the newspaper has highlighted the differing economic realities of the tech industry and modern journalism.

Former Post executive editor Marty Baron, who led the paper to win 11 Pulitzer prizes, expressed his concerns about the newspaper's direction in an interview.

"The aspirations of this news organization are diminished. I think that’ll translate into fewer subscribers. And I hope it’s not a death spiral, but I worry that it might be."

While the financial operations of Amazon and The Washington Post are separate, the juxtaposition of these events underscores a broader economic narrative. As capital flows overwhelmingly toward AI and technology, legacy institutions like newspapers face mounting pressure to find sustainable business models in a rapidly changing digital landscape. Amazon's investment is a bet on a future shaped by AI, while the cuts at the Post reflect the ongoing challenges for journalism in that same future.