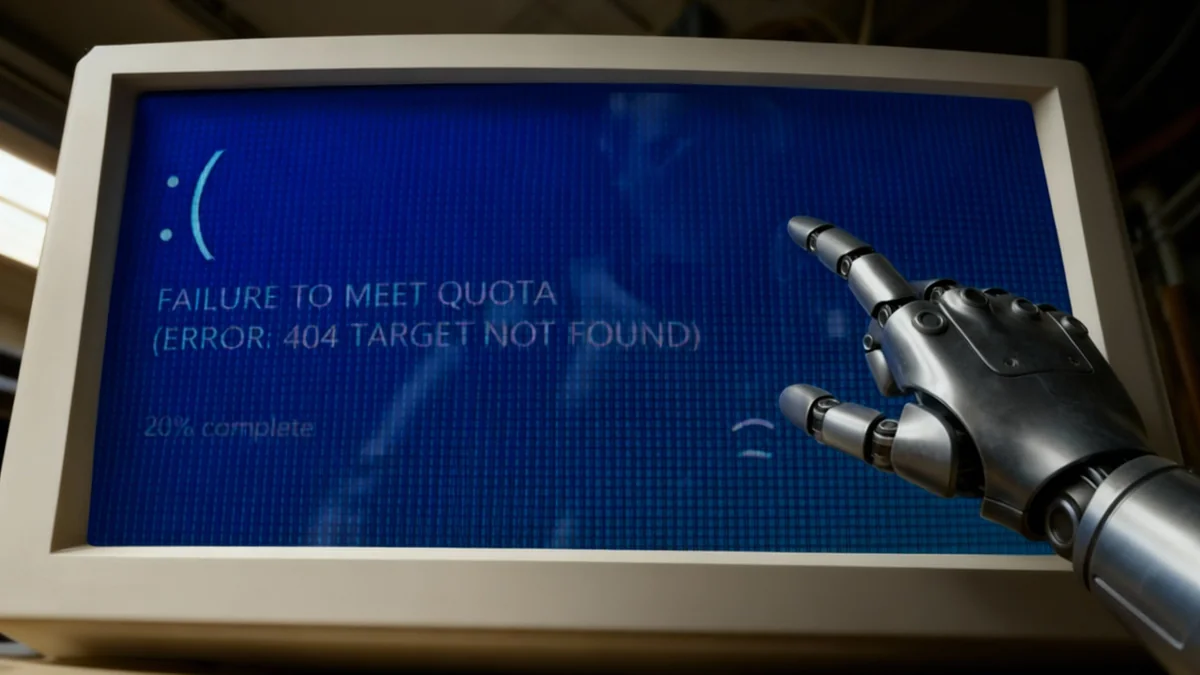

Microsoft is adjusting its internal sales targets for advanced artificial intelligence software, a strategic shift that signals growing customer hesitation to adopt the newest and most expensive AI products. The move reflects a broader market reality where businesses are carefully weighing the costs and practical benefits of cutting-edge technology.

The decision to lower sales quotas for its Azure cloud and AI services suggests that the initial surge of enthusiasm for generative AI is now meeting the pragmatic challenges of enterprise implementation. Companies are increasingly questioning the immediate return on investment for sophisticated AI tools, leading to a more cautious approach to purchasing.

Key Takeaways

- Microsoft has reportedly lowered internal sales quotas for its newer AI software products.

- The adjustment points to customer resistance, likely driven by high costs and unclear immediate value.

- This development suggests a market shift from AI hype towards more practical, value-driven adoption.

- The focus may be shifting to ensuring customers successfully use the products they already have, rather than pushing for new, complex sales.

A Strategic Pivot in Sales Focus

In a notable change of direction, Microsoft is recalibrating the sales incentives for its team. Previously, significant emphasis was placed on selling the latest AI solutions, including those built on technology from its partner, OpenAI. However, the new approach involves reducing these ambitious targets.

This is not an abandonment of AI, but rather a recognition of the current business climate. Many organizations, while intrigued by the potential of generative AI, are struggling to identify clear use cases that justify the significant financial outlay. The complexity of integrating these new systems into existing workflows is another major hurdle.

By lowering the quotas, Microsoft may be encouraging its sales force to focus on customer success with existing products. This strategy prioritizes long-term relationships and demonstrable value over aggressive, short-term sales of nascent technologies.

Microsoft's Heavy Investment in AI

Microsoft has positioned itself as a leader in the AI revolution, largely through its multi-billion dollar partnership with OpenAI, the creator of ChatGPT. This collaboration has led to the integration of advanced AI capabilities across Microsoft's product suite, from the Azure cloud platform to its Office software via services like Microsoft 365 Copilot.

Understanding the Roots of Customer Hesitation

The resistance from customers is not born from a disbelief in AI's potential, but from practical business considerations. Several factors are contributing to this cautious stance among corporate buyers.

The High Cost of Innovation

Implementing enterprise-grade AI is expensive. The costs include not only the software licenses but also the cloud computing resources required to run the models, the training of employees, and the potential need to hire specialized talent. For many companies, the immediate return on this investment is not yet clear.

"We're seeing a transition from the 'AI curiosity' phase to the 'show me the value' phase," noted one industry analyst. "Companies are asking tough questions about how these tools will concretely improve their bottom line, and the answers aren't always straightforward."

Implementation and Integration Challenges

Deploying new AI tools is far from a plug-and-play process. Businesses must consider:

- Data Security: Ensuring that sensitive company data remains secure when used with AI models is a top priority.

- Workflow Integration: Fitting powerful new tools into established business processes without causing disruption is a complex task.

- Employee Training: A workforce needs to be trained to use these new tools effectively and responsibly.

- Measuring Success: Establishing clear metrics to track the performance and ROI of AI initiatives can be difficult.

The Broader Market Picture

The enterprise AI market is projected to grow significantly over the next decade. However, this growth depends on vendors successfully demonstrating tangible value and overcoming the initial barriers to adoption that many potential customers are now facing.

Implications for the AI Industry

Microsoft's adjustment is a significant indicator for the entire technology sector. It suggests that the initial, explosive hype cycle for generative AI may be maturing into a more sustainable, albeit slower, period of growth. This phase will be defined by practical applications and proven results rather than pure potential.

This shift could force other AI providers to re-evaluate their own sales strategies. The focus will likely move from simply selling access to powerful models to providing comprehensive solutions that solve specific business problems. Vendors who can help customers navigate the complexities of implementation and clearly demonstrate value will be best positioned for success.

Ultimately, this development may be a healthy correction for the industry. It signals a move away from speculative investment in technology towards a more grounded approach focused on creating real-world utility. For businesses, it means that AI providers will need to work harder to prove their worth, potentially leading to better products and more supportive partnerships in the long run.