The U.S. Federal Trade Commission (FTC) has filed a lawsuit against the artificial intelligence-powered search company JustAnswer, alleging it engaged in widespread consumer deception. The complaint claims the company, which operates the AI chatbot Pearl, used deceptive tactics to lock hundreds of thousands of consumers into expensive, recurring subscription plans without their clear consent.

The lawsuit, filed on Tuesday, accuses JustAnswer of employing "dark patterns" to trick users who believed they were making a one-time payment for a service. Instead, they were immediately enrolled in monthly subscriptions with fees as high as $79, a practice federal regulators say generated a flood of consumer complaints.

Key Takeaways

- The FTC is suing AI search company JustAnswer for alleged "rampant consumer deception."

- The lawsuit claims the company used misleading interfaces, known as "dark patterns," to enroll users in recurring subscriptions.

- Consumers were allegedly charged initial small fees of $1 or $5, which then triggered much larger monthly charges up to $79.

- JustAnswer denies the allegations, stating its pricing is clear and cancellation is straightforward.

Federal Regulators Detail Alleged Deception

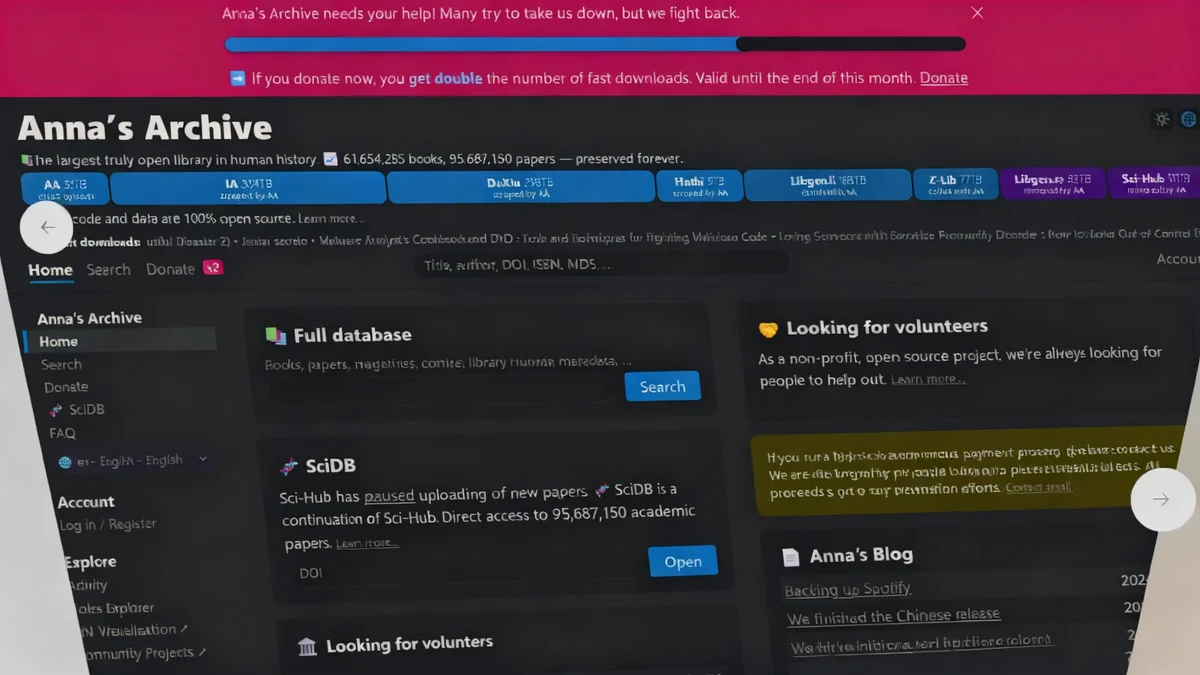

The federal complaint outlines a specific process that investigators say misled consumers. The user journey typically began with a web search, leading to one of the hundreds of websites controlled by JustAnswer, including Pearl.com, JustAnswer.com, AskALawyer.com, and AskWomensHealth.com.

On these sites, a chatbot assistant named Pearl would engage the user, asking for more details about their query. After this interaction, the user was presented with a payment form to access the company's question-and-answer service for a small fee, often listed as $1 or $5.

According to the FTC, this is where the alleged deception occurred. The lawsuit states that upon entering their credit card information for the small initial fee, consumers were immediately charged for both that fee and a significantly higher monthly subscription fee. These fees, which could reach $79, would then recur each month until the user managed to cancel.

Regulators point out that the details of the recurring subscription were often hidden in fine print located just above a large, prominent button labeled "Confirm now." The FTC alleges this design was intentional and constituted a violation of federal consumer protection laws.

The Role of 'Dark Patterns'

The techniques allegedly used by JustAnswer are often referred to as "dark patterns." This term describes user interface designs crafted to trick or manipulate users into making choices they would not otherwise make, such as signing up for unwanted services or sharing more personal data than intended. The FTC has increased its scrutiny of such practices across the digital landscape.

A Flood of Consumer Complaints

The federal investigation, which began in 2022, was reportedly prompted by a large volume of complaints from consumers who felt they had been scammed. The lawsuit highlights that hundreds of thousands of individuals were affected by these practices, describing the company's behavior as "scammy."

The complaint also takes direct aim at the company's leadership. It alleges that JustAnswer's CEO, Andy Kurtzig, was aware of the consumer deception but chose not to implement changes to make the subscription model clearer. The FTC is now seeking a court injunction to stop the company from continuing these alleged practices.

Company Profile

JustAnswer, a company with approximately 700 employees, has raised around $50 million in funding, according to market intelligence firm PitchBook. The lawsuit places its business model under intense legal and public scrutiny.

JustAnswer Responds to Allegations

In response to the lawsuit, JustAnswer has expressed its disappointment with the FTC's decision to pursue legal action. The company maintains that it has been cooperating with the agency for nearly three years.

"We clearly publish our pricing and model upfront, and make cancelling simple and convenient through multiple channels, including a 24/7 toll-free number, live chat, email and with one click on the web," stated JustAnswer spokesman Ashe Reardon.

The company's position is that its terms are transparent and that it provides multiple accessible avenues for customers who wish to end their subscriptions. This defense directly contradicts the FTC's claims that the cancellation process was part of the deceptive framework designed to trap consumers.

A Broader Crackdown on Deceptive Practices

This lawsuit is part of a larger trend of regulatory action against companies accused of using dark patterns. Legal experts note that while these tactics can be highly profitable, they are drawing increasing attention from regulators.

Andrea Matwyshyn, a professor at Penn State Law specializing in internet regulations, explained that these deceptive designs are common. They are often used to get users to agree to maximum data sharing or, as alleged in this case, to trap them in recurring transactions that are difficult to exit.

Lior Strahilevitz of the University of Chicago Law School added that the FTC and state attorneys general frequently sue companies over unlawful dark patterns. He noted that such schemes prey on consumers who may not notice the charges immediately or who find the process of seeking a refund too cumbersome.

The FTC's action against JustAnswer follows similar high-profile cases, including a lawsuit against Amazon for allegedly tricking consumers into auto-renewing their Prime subscriptions. This latest case underscores the government's commitment to protecting consumers from misleading digital sales tactics in an increasingly complex online marketplace.