Despite a government-led investment exceeding $150 billion, China's semiconductor industry is struggling to produce the high-performance chips needed to power its artificial intelligence ambitions. Top technology executives have identified this hardware gap as a significant obstacle, even as domestic firms like Huawei work to close the distance with global leaders.

The push for self-sufficiency has yielded progress, but Chinese chipmakers still produce fewer and less powerful semiconductors compared to their international rivals. This reality check comes at a critical time, as the country's leading AI companies report that a lack of advanced chips is holding back their potential to lead the world.

Key Takeaways

- China has invested more than $150 billion to build a self-sufficient semiconductor industry.

- Domestic chip production lags behind foreign competitors in both quantity and performance.

- The country's top AI firms, including Tencent and Alibaba, cite the chip shortage as a major growth barrier.

- Huawei estimates it will take nearly two more years to produce chips that match the current performance of Nvidia's offerings.

A Massive Investment Meets a Hard Reality

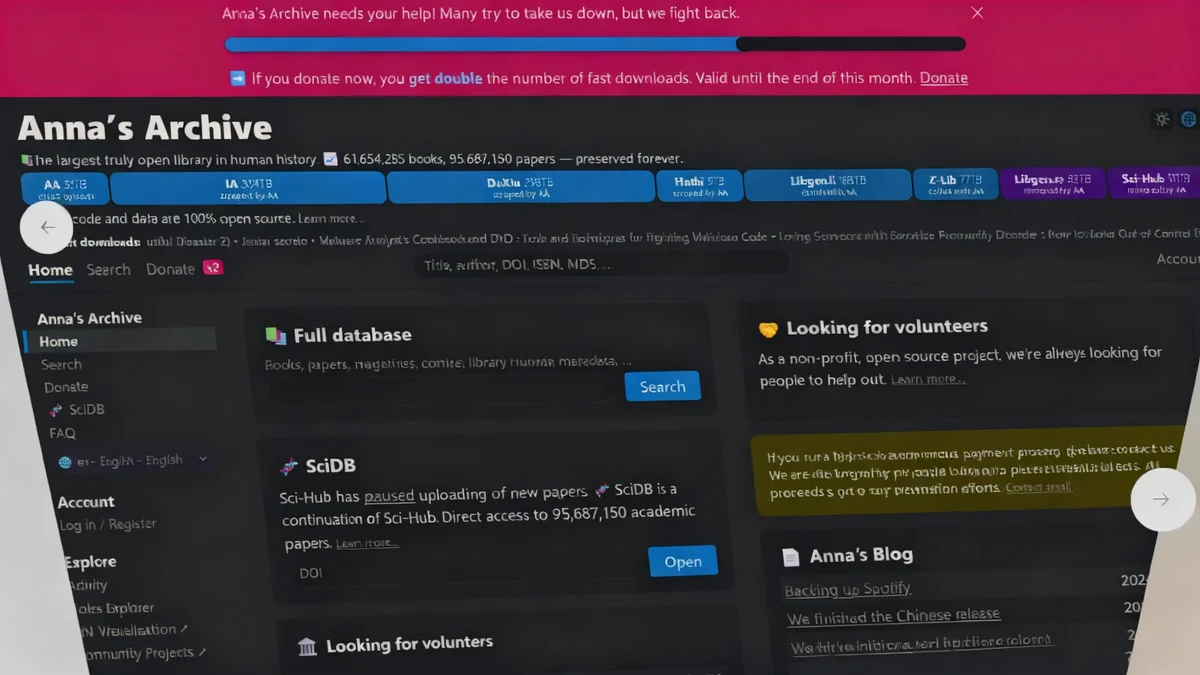

For over a decade, Beijing has made semiconductor independence a national priority. The government has poured vast sums of money into companies like Semiconductor Manufacturing International Corporation (SMIC) to build a domestic industry capable of competing on the world stage.

Over $150 Billion Committed

The Chinese government's financial commitment to its domestic chip industry is one of the largest state-backed industrial efforts in modern history, aimed at reducing reliance on foreign technology.

This strategic push is designed to secure China's technological future and insulate it from geopolitical pressures. However, the complex and capital-intensive nature of semiconductor manufacturing has proven to be a formidable challenge. Building cutting-edge fabrication plants, known as fabs, and mastering the intricate production processes takes years of accumulated expertise.

While the investment has expanded China's production capacity for older, more mature chip technologies, it has not yet cracked the code for the most advanced processors. These are the critical components required for high-end servers, AI model training, and sophisticated consumer electronics.

AI Ambitions Hit a Hardware Wall

The limitations of the domestic chip industry were a central topic at a recent conference at Tsinghua University in Beijing. The event brought together influential figures from China's most powerful technology companies, including Tencent, Alibaba, and Zhipu AI.

Sources present at the gathering described the mood as optimistic about the potential of Chinese AI, but also acutely aware of a significant bottleneck. The consensus was clear: a shortage of high-performance semiconductors is the primary factor limiting their progress.

"One of the companies in the room could soon lead the world... But one thing was holding them back: They needed more superfast semiconductors."

This hardware deficit directly impacts their ability to train larger, more complex AI models at the speed and scale of their global competitors. While software and algorithms are advancing rapidly, the underlying hardware infrastructure is not keeping pace, creating a frustrating performance ceiling for the entire industry.

Why Advanced Chips Matter for AI

Modern artificial intelligence, especially large language models, requires immense computational power. Advanced chips, or GPUs, from companies like Nvidia can perform trillions of calculations per second, allowing AI models to be trained in weeks instead of years. Access to these chips is a direct competitive advantage in the global AI race.

Huawei's Race to Catch Up

At the forefront of China's effort to close the technology gap is Huawei. The telecommunications giant has been forced to develop its own chip ecosystem after facing international restrictions. Its progress is seen as a barometer for the success of China's broader self-sufficiency campaign.

Despite some notable successes, the company acknowledges the long road ahead. Huawei has publicly stated it will require almost another two years to manufacture chips that can perform on par with the current generation of high-end processors from industry leader Nvidia.

This two-year timeline highlights the moving target that Chinese firms are chasing. By the time Huawei reaches the performance level of today's top chips, competitors like Nvidia will have likely released even more powerful next-generation hardware. This continuous cycle of innovation makes catching up an incredibly difficult and expensive endeavor.

The Performance and Production Gap

The challenge is twofold. Chinese firms are not only behind in performance but also in scale. This year, domestic chipmakers are projected to produce only a small fraction of the advanced chips manufactured by their foreign rivals.

This gap has several root causes:

- Access to Equipment: Restrictions on advanced lithography machines, which are essential for printing complex circuits on silicon, limit production capabilities.

- Intellectual Property: Decades of research and development give established players a significant head start in chip design and manufacturing processes.

- Talent Pool: While growing, China's pool of experienced semiconductor engineers is still smaller than that of established hubs like Taiwan and the United States.

Addressing these fundamental issues requires more than just capital; it demands sustained, long-term investment in research, education, and the development of a complex supply chain. While China's determination is clear, the path to true semiconductor independence remains steep and fraught with challenges.