The long-held promise of nuclear fusion, a source of nearly limitless clean energy, is moving from scientific theory to commercial reality. Following a major scientific breakthrough in 2022, a wave of private companies, backed by major technology firms and investors, are now in a race to build the world's first fusion power plant, with some targeting grid connection as early as the next decade.

The growing energy demands of artificial intelligence and data centers are accelerating this shift, transforming the conversation about fusion from a question of 'if' to 'when'.

Key Takeaways

- A 2022 experiment at Lawrence Livermore National Laboratory successfully produced more energy from fusion than was used to start the reaction, a milestone known as "ignition."

- Companies like Commonwealth Fusion Systems, Helion, and Type One Energy are developing commercial fusion plants, with timelines aiming for the early 2030s.

- Major technology firms, including Microsoft and Google, are signing power purchase agreements to fuel their energy-intensive AI operations with fusion.

- Private investment in the fusion sector has surpassed $10 billion, signaling strong confidence in its commercial viability.

The Scientific Foundation for a New Energy Era

For decades, nuclear fusion was considered a distant dream. The process, which powers the sun by fusing atoms together to release immense energy, has been notoriously difficult to replicate and sustain on Earth. Unlike nuclear fission, which splits atoms and produces long-lived radioactive waste, fusion offers the potential for clean, safe, and abundant power.

A pivotal moment occurred in late 2022 when scientists at the Lawrence Livermore National Laboratory achieved what is known as "first ignition." For the first time, a controlled fusion reaction generated more energy than it consumed. This achievement was described as a "Wright brothers' moment" for the industry, proving that net-energy-gain fusion was possible.

Annie Kritcher, the project's principal designer, has since co-founded a company to commercialize the technology.

"Fusion is the holy grail of energy. It’s a clean, no-carbon, unlimited fuel source," Kritcher stated. "It’s powering hope for our generation and future generations to come."

A Competitive Race to Build a Commercial Plant

The scientific success has ignited a competitive commercial race, with several well-funded startups pursuing different technological paths to the same goal: a functional power plant.

Fusion vs. Fission Explained

Nuclear Fission is the process used in today's nuclear power plants. It involves splitting heavy atoms, like uranium, to release energy. This process creates long-term radioactive waste that requires careful storage.

Nuclear Fusion does the opposite. It combines light atoms, such as hydrogen isotopes, under extreme heat and pressure to form a heavier atom, releasing vast amounts of energy. Its primary fuel source can be derived from water, and it does not produce high-level radioactive waste.

Commonwealth Fusion Systems (CFS)

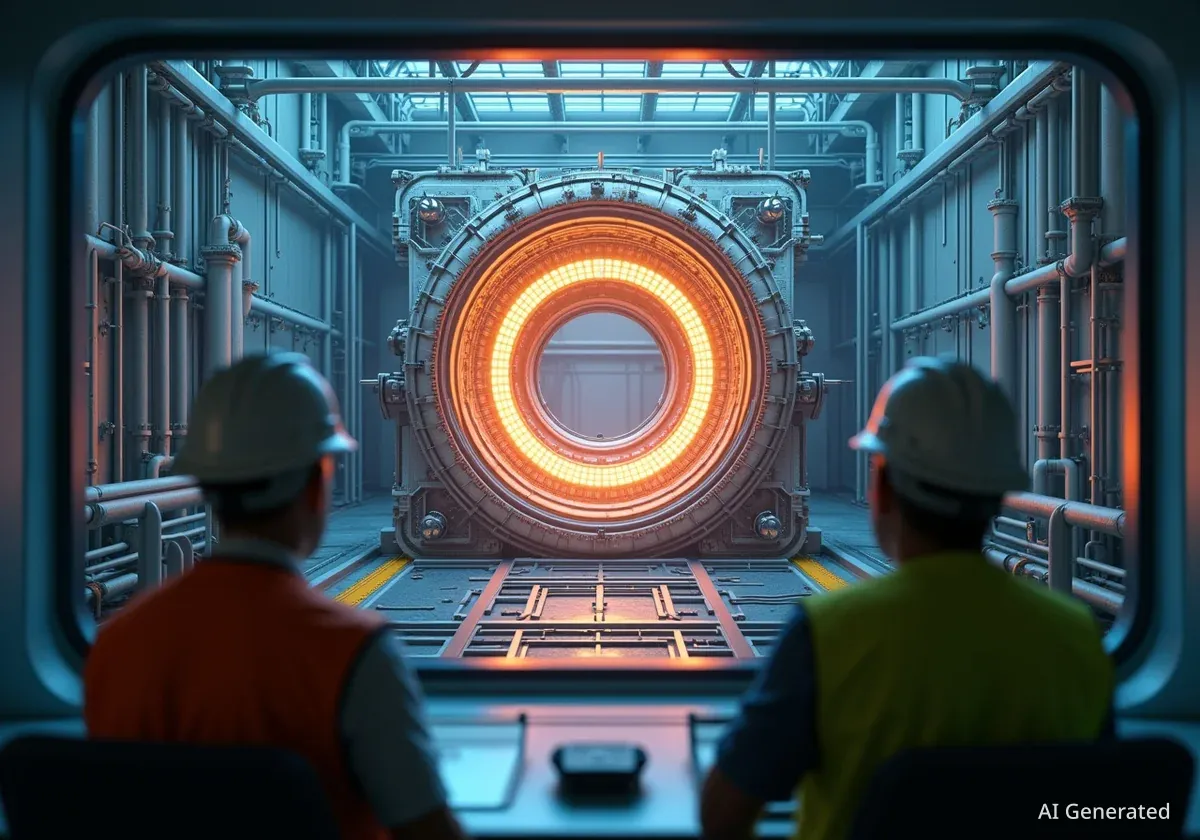

A spinoff from the Massachusetts Institute of Technology (MIT), CFS is a leader in the field, having raised approximately $3 billion in private funding. The company uses a technology called a tokamak, a doughnut-shaped device that uses powerful magnets to contain superheated plasma.

- SPARC Project: A pilot plant currently under construction near Boston, expected to be operational by 2027.

- ARC Project: The company's first commercial-scale plant, planned for the early 2030s near Richmond, Virginia. It is designed to produce 400 megawatts of electricity, enough to power around 300,000 homes.

CFS has already secured power purchase agreements with Google and Italian energy company Eni for its ARC plant. "We need a power plant making power, and we need that as soon as possible," said Bob Mumgaard, CEO of CFS.

Helion and Type One Energy

Other major players are also making significant progress. Helion, backed by OpenAI CEO Sam Altman, is developing a fusion plant near Seattle intended to power Microsoft's data centers. This highlights the strong synergy between the AI industry's massive energy needs and fusion's potential for reliable, clean power.

Type One Energy, another company supported by Bill Gates' Breakthrough Energy Ventures, plans to build its first commercial plant at the site of a retired coal facility in Tennessee. The project, named Infinity Two, aims to come online by the early 2030s and will use a technology called a stellarator, a more complex design that aims to improve plasma stability over the tokamak.

The Fuel for a Star

The primary fuels for many fusion reactor designs are deuterium and tritium, which are isotopes of hydrogen. Deuterium can be extracted from seawater. According to Kritcher, the fuel needed to power one person's entire lifetime could be sourced from a bathtub of seawater and a small amount of lithium the size of a laptop battery.

The Driving Force of AI and Big Tech

The exponential growth of artificial intelligence is a primary catalyst for the accelerated interest in fusion. Data centers that train and run large AI models consume enormous amounts of electricity, and tech companies are seeking sustainable and dependable energy sources to meet this demand.

"For hyperscalers, you have a buildout of infrastructure that’s very energy hungry," Mumgaard explained. "They need a lot of power in a concentrated way. They need it all the time. The use case fits fusion very well."

Microsoft founder Bill Gates, a prominent investor in the sector, has called fusion one of the "coolest" things he is working on.

"If you know how to build a fusion power plant, you can have unlimited energy anywhere and forever. It’s hard to overstate what a big deal that will be," Gates wrote.

Overcoming Engineering and Financial Hurdles

Despite the optimism, significant challenges remain. The core science is increasingly understood, but the task has now shifted to engineering and economics. Companies must build and operate complex machines at an unprecedented scale, all while proving they can be cost-effective.

Prakash Sharma, an analyst at Wood Mackenzie, projects that global electricity demand will nearly double by 2050. He believes fusion is no longer a question of 'if' but 'when'. "The challenges are being overcome, especially given the momentum behind the technologies and the interest from a number of different players like Google and Microsoft," Sharma said.

Analysts suggest that while the first fusion plants may connect to the grid in the 2030s, it could take until 2050 or later for the technology to represent a significant portion of the global energy supply. Charles Boakye, an analyst at Jefferies, compared its potential growth to solar power. "It took solar power 25 years to reach its first terawatt, and then it took two years to reach its second terawatt. Once you hit that inflection point, you start to see real gains," Boakye noted.

Regulatory frameworks are also proving to be an advantage. In the United States, the Nuclear Regulatory Commission has decided to regulate fusion facilities under a less stringent framework than traditional fission plants, potentially shortening development timelines from years to months. This streamlined approach, combined with strong private investment and a clear market demand from the tech industry, has created a powerful tailwind for the once-futuristic energy source.