Online learning company Chegg announced a significant corporate restructuring on Monday, confirming it will reduce its workforce by approximately 45%. The move, which affects about 388 employees, comes as the company grapples with the widespread adoption of artificial intelligence and a notable decrease in traffic from Google search results.

In a concurrent leadership shuffle, Executive Chairman Dan Rosensweig will return to his former role as President and Chief Executive Officer. The Santa Clara-based firm stated the changes are a direct response to a major decline in both user traffic and revenue, forcing a strategic pivot toward the professional skills market.

Key Takeaways

- Chegg is laying off approximately 388 employees, representing 45% of its total workforce.

- Former CEO Dan Rosensweig is returning to lead the company, succeeding Nathan Schultz.

- The company cited the rise of generative AI and reduced Google search traffic as the primary reasons for the restructuring.

- Chegg will shift its focus to the professional 'skilling market,' valued at over $40 billion.

- The layoffs are expected to reduce annual expenses by $100 million to $110 million by 2026.

A Major Restructuring in Response to AI

Chegg Inc. detailed its restructuring plan in a statement, framing it as a necessary step to adapt to a rapidly changing digital landscape. The company directly linked its recent struggles to generative AI tools that provide instant answers to students, a service that was once Chegg's core business.

The workforce reduction is a key part of a broader cost-saving initiative. Chegg anticipates that the layoffs will decrease its non-GAAP expenses by a substantial $100 million to $110 million annually by 2026. However, the company will incur one-time charges between $15 million and $19 million, primarily for cash severance and related termination benefits for the affected employees.

Financial Impact

The restructuring is designed to create a leaner organization. While the immediate cost is up to $19 million in severance, the long-term goal is to achieve over $100 million in annual savings to reinvest in new growth areas.

This move follows months of internal review where the company explored various options, including a potential sale or going private. Ultimately, the board decided that remaining an independent public company was the best path forward to maximize long-term shareholder value.

Leadership and Strategic Direction Shift

The return of Dan Rosensweig to the CEO position signals a significant change in direction. Rosensweig previously led the company for over a decade before Nathan Schultz took the helm in 2024. Schultz will now transition to an advisory role, assisting Rosensweig and the board during this period of transformation.

"As I return to the CEO role, I’m confident Chegg has a bright future, and I look forward to exploring all paths to drive growth and enhance shareholder value," Rosensweig said in the company's official release.

His immediate task is to navigate the company away from its traditional homework-help model and toward a more resilient business line. The new focus is the professional 'skilling market,' a sector Chegg estimates to be worth over $40 billion. This market includes corporate training, professional certifications, and upskilling programs for adults already in the workforce.

The Dual Challenge of AI and Search Traffic

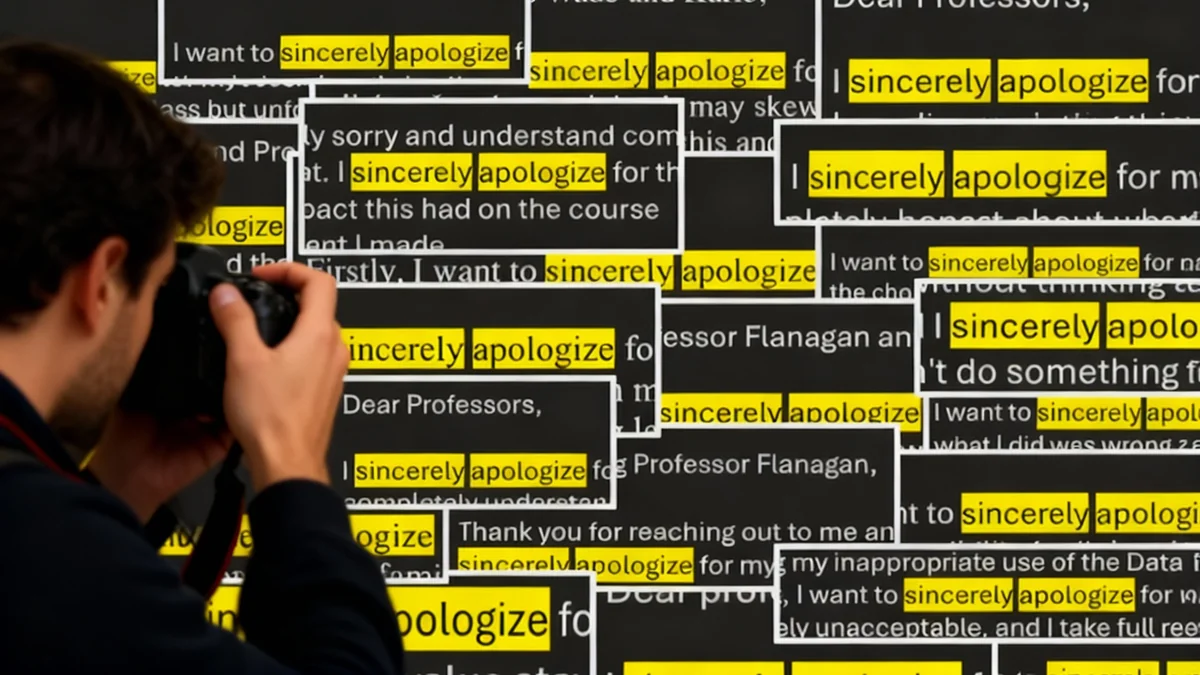

Chegg’s announcement explicitly identified two external forces driving its difficulties. The first is the rapid advancement and adoption of generative artificial intelligence. AI platforms can now perform many of the functions that previously drew students to Chegg's services, creating a powerful and often free alternative.

The second major factor is a change in how Google directs traffic. The company noted "reduced traffic from Google to content publishers," which has severely impacted its ability to attract new users. This reflects a broader trend where search engines are increasingly providing direct answers rather than just links, keeping users on their own platforms.

A Changing Educational Landscape

The education technology sector has been one of the first industries to feel the full disruptive force of generative AI. Companies that built their models on providing information and answers are now competing with AI that can generate that same information instantly. This has forced many, like Chegg, to fundamentally rethink their value proposition and business strategy.

In its statement, the company acknowledged the severity of the situation. "The new realities of AI and reduced traffic from Google to content publishers have led to a significant decline in Chegg’s traffic and revenue," the company stated, providing a clear rationale for the drastic measures.

Navigating an Uncertain Future

While Chegg has outlined a new path forward, it also cautioned investors about the inherent risks. The company's future success depends on its ability to effectively penetrate the skilling market and stabilize its core business by attracting new learners despite the ongoing traffic declines.

The company reiterated its financial guidance for the third quarter but warned of "risks and uncertainties" tied to the evolving AI landscape. This includes the broader effects of AI technology on the economy and Chegg's specific ability to compete in this new environment.

The overhaul at Chegg serves as a stark example of how quickly AI is reshaping established digital businesses. The company's ability to execute its pivot to professional skilling will be closely watched by investors and the wider technology industry as a test case for adapting to the age of artificial intelligence.