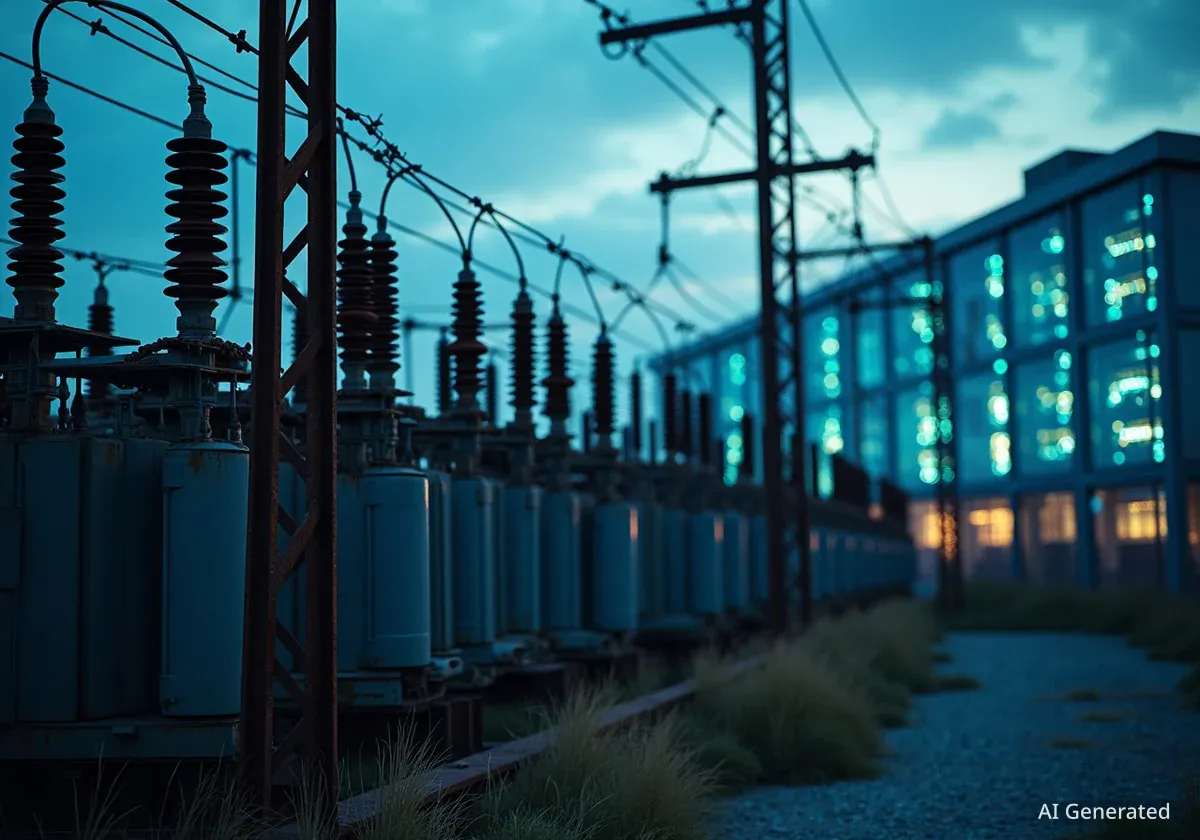

The rapid expansion of artificial intelligence is creating an unprecedented demand for electricity, a demand that the aging U.S. power grid is unprepared to meet. While much of the focus has been on advanced semiconductors, the true bottleneck for American AI dominance lies in its neglected energy infrastructure, a problem decades in the making.

The U.S. Department of Energy has issued stark warnings, projecting that without massive investment, widespread blackouts could become a common occurrence by 2030. This infrastructure deficit not only threatens the nation's technological ambitions but also presents a critical challenge to its economic and national security, especially as competitors like China rapidly expand their own energy capacity.

Key Takeaways

- The primary constraint for the U.S. AI industry is not a shortage of computer chips, but a lack of sufficient electrical power and transmission infrastructure.

- The U.S. electrical grid received a D+ grade from the American Society of Civil Engineers, highlighting decades of underinvestment.

- China is aggressively building its energy infrastructure, including coal, nuclear, and ultrahigh-voltage lines, creating a significant competitive advantage.

- Massive global investment in power grids is expected, reaching nearly $600 billion annually by 2030, creating opportunities for companies specializing in electrical equipment and transmission.

The Unseen Crisis Powering AI

The artificial intelligence revolution runs on electricity. Training a single large AI model consumes as much power as hundreds of homes for a year, and the data centers that house them are some of the most energy-intensive facilities on Earth. This has created a voracious appetite for power that is exposing the fragility of America's grid.

For decades, the U.S. has deferred maintenance and upgrades on its electrical systems. The consequences are now becoming clear. The American Society of Civil Engineers gave the nation's grid a D+ grade, a rating that signals systemic issues and a high risk of failure. This isn't a future problem; it's a current reality that is slowing down progress.

Tech giants have recognized this vulnerability. Faced with connection wait times that have ballooned from two years in 2008 to nine years today, companies are now investing billions to build their own power plants. When technology companies feel compelled to become utility providers, it signals a fundamental failure in public infrastructure.

A Stark Warning from Federal Engineers

In July 2025, the U.S. Department of Energy (DOE) warned that power blackouts could increase by a factor of 100 by the year 2030. This could translate to Americans experiencing power outages for 34 to 55 days per year, a dramatic increase from the mere hours currently experienced.

A Tale of Two Grids: The US vs. China

The state of U.S. energy infrastructure stands in stark contrast to that of its primary technological competitor, China. While the U.S. operates with an electricity reserve margin of just 15%, meaning a small disruption can lead to outages, China maintains a reserve margin between 80% and 100%.

This disparity is the result of deliberate, long-term strategic investment. Over the past 15 years, China has built 42 ultrahigh-voltage (UHV) transmission lines, which are critical for moving massive amounts of power efficiently across long distances. In that same period, the United States built zero.

The manufacturing gap is just as wide:

- Transformers: Chinese manufacturers can deliver essential transformers in 48 weeks at a cost 20% to 40% lower than their U.S. counterparts, who face lead times of three years or more.

- Transmission Lines: The U.S. built 888 miles of high-capacity transmission lines in 2024, far short of the 5,000 miles per year the DOE recommends. America is building at only 18% of the required pace.

- Power Generation: In 2024 alone, China began construction on 95 gigawatts of new coal capacity. It is also building half of the world's new nuclear reactors, approving 10 new projects in April 2025. The U.S. has brought only two new reactors online in the past decade.

This aggressive build-out means China can deploy new data centers without worrying about grid capacity, while American projects face significant delays and uncertainty.

White House Acknowledges the Constraint

The urgency of the situation was officially recognized in July 2025, when the Trump administration's AI Action Plan identified energy infrastructure as the "primary constraint" to American AI leadership. This marked a significant admission that decades of neglecting infrastructure development have created a national security vulnerability.

The Multi-Trillion Dollar Scramble to Catch Up

The realization of this infrastructure crisis is beginning to mobilize capital. A recent private sector effort mobilized $92 billion for grid modernization in Pennsylvania alone, signaling the scale of investment required nationwide. However, this is just the beginning of what analysts describe as a massive, multi-decade investment cycle.

According to BloombergNEF, global investment in power grids is projected to reach $594 billion annually by 2030. The total investment needed through 2050 is estimated at a staggering $15.8 trillion. This capital will fund the construction of an estimated 17.4 million miles of new transmission and distribution lines worldwide.

"This isn’t a utility story about dividend yields. This is the infrastructure constraint that determines whether America can actually power AI and reshore manufacturing — or whether Washington just talks while Beijing builds."

This spending is not on abstract software but on physical hardware: transformers, high-voltage cables, and control systems. The companies that produce this essential equipment are positioned at the chokepoint of the entire AI and manufacturing boom.

The Companies Powering the Future

As the U.S. and other advanced economies rush to upgrade their grids, a handful of global companies that specialize in electrical equipment stand to benefit. These are not the high-flying tech stocks that dominate headlines, but the industrial giants that build the backbone of the modern world.

Global equipment leaders like Hitachi and ABB are central to this build-out. Hitachi has already committed $1 billion to expand its U.S. manufacturing capacity to meet rising demand. Similarly, specialists in high-voltage cables, such as Prysmian, are crucial for developing the new transmission lines needed to connect power sources to data centers.

The investment thesis is straightforward: you cannot run an AI-driven economy on a 20th-century power grid. The lights must stay on, and these are the companies that provide the essential components to make that happen. The race for AI supremacy will be won not just with algorithms, but with transformers, cables, and raw electrical power.