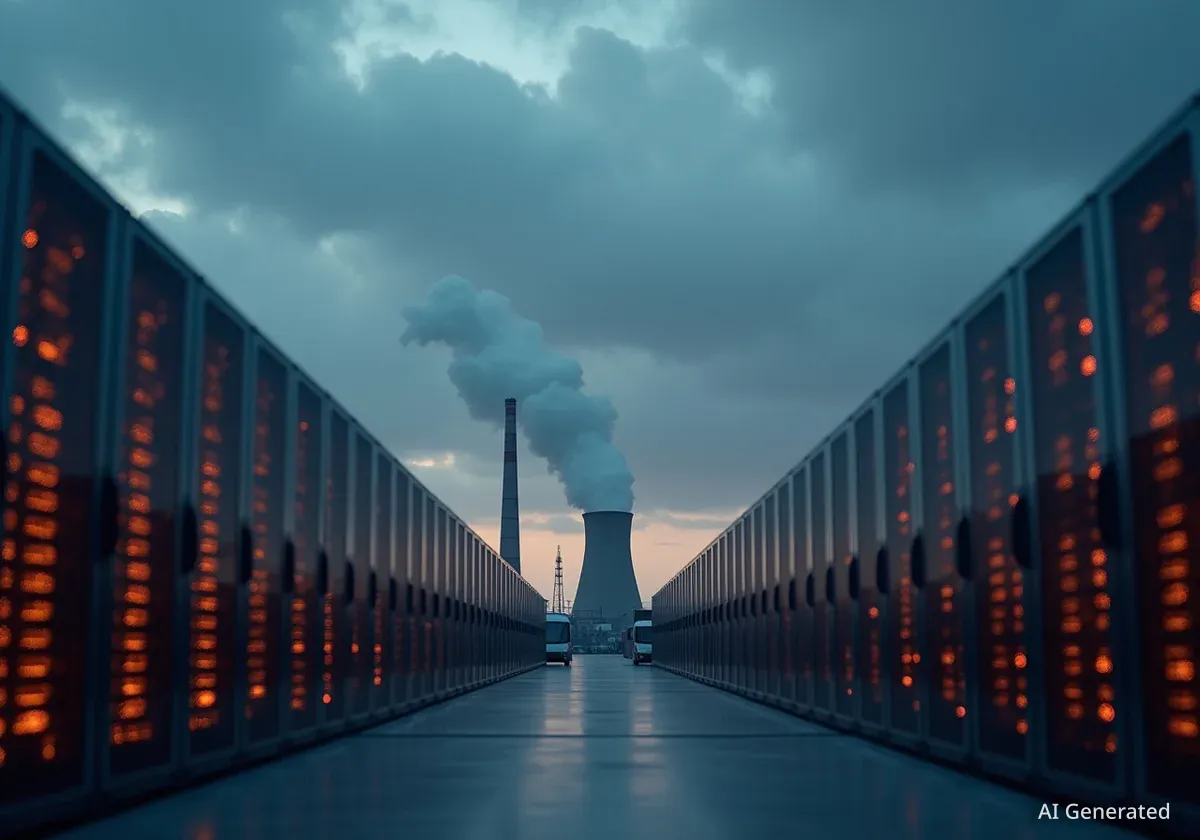

The rapid growth of artificial intelligence is fueling projections of massive energy consumption, prompting utilities to plan a significant expansion of fossil fuel infrastructure. However, a new report suggests these forecasts may be inflated, creating a risk that the United States could invest in unnecessary natural gas plants, leading to higher consumer costs and increased pollution.

Key Takeaways

- Projections for AI-driven electricity demand might be significantly overestimated due to speculative development and duplicate requests to utilities.

- U.S. utilities have proposed a 70% increase in new natural gas capacity, largely to serve anticipated data center growth.

- A report from As You Sow and the Sierra Club warns this could lock in decades of fossil fuel dependency and undermine climate goals.

- Experts suggest solutions like greater transparency from developers and stronger commitments to renewable energy from tech companies.

The Surge in Energy Projections

For more than a decade, electricity demand in the United States remained relatively stable, thanks to improvements in energy efficiency. The recent boom in generative AI has changed this outlook dramatically. Tech companies require vast amounts of power to train and operate complex AI models, leading to a surge in requests for new grid connections.

This has caused utilities and independent developers to propose a substantial increase in new natural gas projects. According to analysis, proposals submitted between January 2023 and January 2025 could expand the nation's gas-fired power plant fleet by nearly one-third. This represents a 70% jump in proposed gas capacity compared to the period before the AI boom.

A Small Town's Worth of Power

The energy density of AI hardware is a key driver of this demand. A traditional data center rack uses about 6-8 kilowatts of power, comparable to three U.S. homes. In contrast, a high-density AI rack can require upwards of 100 kilowatts, equivalent to the electricity used by 80 to 100 homes. "Essentially what you’re looking at is a small town’s worth of power being deployed," explained Dan Thompson, a principal research analyst at S&P Global.

Speculation and Uncertainty Cloud Forecasts

While the energy needs of AI are real, a joint report by shareholder advocacy group As You Sow and environmental organization Sierra Club highlights significant uncertainty in future demand. The report, published in September 2025, argues that the market is flooded with speculators aiming to build and sell data centers quickly.

These speculators often submit connection requests to multiple utilities for the same project to find the best terms, potentially leading to double or even triple counting of future demand. Many requests are also made before developers have secured the necessary capital or clients, meaning a significant portion may never materialize.

"While the AI boom provides exciting opportunities, there are many risks to not approaching energy needs with a deliberate and informed response that takes long term impacts into account," said Kelly Poole, lead author of the report.

This discrepancy is already visible in market data. A report from the Institute for Energy Economics and Financial Analysis (IEEFA) found that utilities in the Southeast—a major data center hub—are projecting up to four times more demand growth than independent industry analyses suggest. Nationally, utility projections are reportedly 50% higher than what the tech industry itself anticipates.

Even utility executives have acknowledged the potential for overestimation. Jim Burke, CEO of Vistra Energy, stated on a Q1 earnings call that proposed grid connection projects "may be overstated anywhere from three to five times what might actually materialize."

The Risk of Stranded Assets and Climate Impact

Acting on inflated projections carries significant financial and environmental risks. If utilities overbuild capacity, especially with long-lasting infrastructure like natural gas plants, they could create "stranded assets." These are facilities that are no longer needed but for which customers must continue to pay, leading to higher utility bills for decades.

Contradicting National Climate Goals

The push for new gas infrastructure runs counter to the Biden administration's objective of achieving a 100% carbon-free power grid by 2035. Building new fossil fuel plants locks in carbon emissions for years, making it more difficult and expensive to transition to clean energy sources like solar and wind.

A prominent example is in Louisiana, where utility Entergy has proposed three new gas plants to power a single large Meta data center. This facility is projected to consume as much electricity as 1.5 million homes and generate 100 million tons of carbon emissions over a 15-year period.

This rush toward fossil fuels is driven partly by the profitability of building new infrastructure for regulated utilities and by a political climate that sometimes favors conventional energy sources. The result is a potential misalignment between short-term energy planning and long-term climate and economic stability.

Pathways to Sustainable Growth

The report from As You Sow and Sierra Club outlines several potential solutions to mitigate these risks. The authors recommend that utilities implement stricter requirements for data center developers seeking grid connections.

These measures could include:

- Requiring developers to disclose if they have submitted proposals to other utilities.

- Mandating long-term service agreements to ensure commitment.

- Increasing nonrefundable deposits and cancellation fees to deter speculative projects.

Tech companies also have a critical role. For years, major firms like Amazon, Google, and Meta have been leading corporate buyers of renewable energy. The report urges them to intensify these efforts by signing long-term power purchase agreements for new solar and wind farms. Such commitments would directly finance the construction of clean energy sources to meet their growing demand, rather than relying on an expanded fossil fuel grid.

By improving transparency, demanding greater commitment from developers, and prioritizing direct investment in renewables, both utilities and the tech industry can support the growth of AI without compromising the transition to a cleaner and more affordable energy system.