Intel is moving to enhance its presence in the artificial intelligence (AI) market by forming a new alliance with TurinTech. This collaboration aims to integrate TurinTech's AI engineering platform, Artemis, with Intel hardware, specifically targeting the growing AI PC segment. This strategic move could open new revenue streams for the chipmaker.

Key Takeaways

- Intel partners with TurinTech to bring Artemis AI platform to Intel hardware.

- Artemis will operate entirely on-device, removing the need for an internet connection.

- The integration leverages Intel's XPU architecture and OpenVINO for high performance.

- Intel's Jaguar Shores AI accelerator chip is expected to complete its design phase by mid-2026.

- Analysts currently rate INTC stock with a 'Hold' consensus.

New AI Capabilities for PCs

The new agreement between Intel and TurinTech will see the Artemis AI engineering platform deployed on Intel's hardware. A key feature of this integration is Artemis's ability to run entirely on-device. This means the AI platform will not require an internet connection to function, offering enhanced security and efficiency for users.

Intel's XPU architecture, combined with OpenVINO integration, will allow Artemis to utilize various processor resources. This setup aims to deliver high performance while keeping other system components free for other tasks. The focus is on creating a robust, self-contained AI environment directly within personal computers.

On-Device Advantage

Artemis running on-device means no internet connection is needed for AI operations, enhancing data privacy and reducing latency for users.

Empowering Developers and Enterprises

Dennis Luo, Intel’s senior director and general manager of AI PC developer relations, emphasized the significance of this collaboration. He stated that the partnership simplifies the process of bringing Artemis directly onto devices. This, in turn, empowers developers to utilize Intel platform capabilities with greater flexibility and efficiency.

"Through our collaboration, we’re making it easier to bring Artemis directly on-device, empowering developers to tap into Intel platform capabilities with greater efficiency and flexibility. For enterprises, this means faster performance, more secure and cost-efficient experiences, building a scalable path to deliver AI-powered value right at the endpoint."

For businesses, this translates into faster performance, more secure operations, and cost-efficient experiences. The goal is to provide a scalable path for delivering AI-powered value directly at the endpoint, which includes individual AI PCs.

Advancements in Datacenter AI Hardware

Beyond the AI PC market, Intel is also making progress in the datacenter AI hardware sector. The company's Jaguar Shores chip, an AI accelerator, is on track to complete its design phase by mid-2026. Intel is already collaborating with ASIC design operation AI chip to advance this project.

This initiative represents a significant step for Intel as it seeks to establish a stronger foothold in the datacenter AI hardware market. This market is currently dominated by several competitors, presenting a challenge for Intel to attract new customers.

Understanding AI Accelerators

AI accelerators are specialized hardware designed to speed up artificial intelligence computations. They are crucial for tasks like machine learning, deep learning, and neural network processing, particularly in datacenters where massive amounts of data are handled.

Breaking into a Competitive Market

To succeed in this competitive landscape, Intel will need to deliver a high-performing chip at a compelling price. The company must also demonstrate that Jaguar Shores is not a short-term offering, but a reliable, long-term solution. Building trust and proving sustained value will be key to drawing customers away from established brands.

The datacenter AI market is dynamic, with continuous innovation and evolving demands. Intel's entry with Jaguar Shores signifies its commitment to expanding its influence across various AI computing segments.

Market Performance and Analyst Outlook

Intel shares saw a modest increase of nearly 2% in Thursday afternoon trading following the announcement of the TurinTech alliance. Over the past year, Intel's share price has rallied by 65.26%, reflecting investor interest in its strategic shifts and product development.

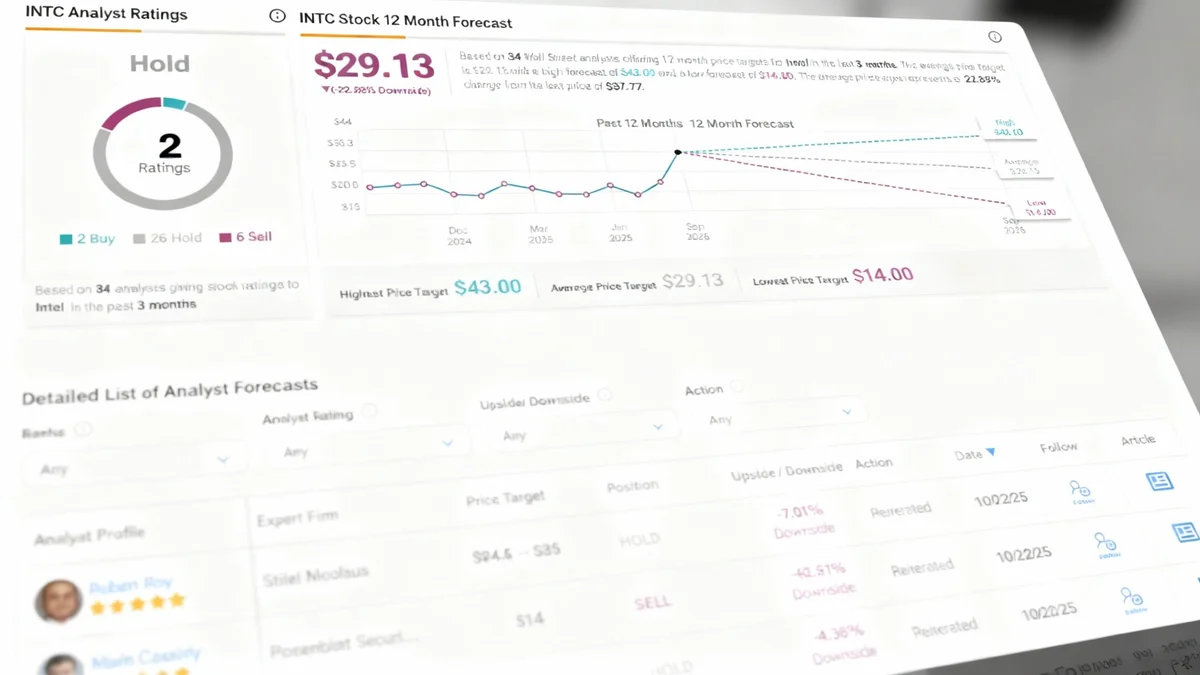

Despite recent gains, Wall Street analysts maintain a 'Hold' consensus rating on INTC stock. This consensus is based on an analysis of recent ratings, which include two 'Buys', 26 'Holds', and six 'Sells' assigned over the past three months. The average price target for INTC stock is $29.13 per share, which implies a 22.88% downside risk from its current valuation.

Broader Market Movements

On Thursday, the broader market also experienced gains. The SPDR S&P 500 ETF Trust (SPY) ended 0.59% higher, tracking a similar rise in the S&P 500 Index. The Nasdaq 100 (NDX) gained 0.88%. These market movements were influenced by several factors, including rising oil prices following new U.S. sanctions on Russia's crude oil industry.

Strong earnings reports from companies like casino operator Las Vegas Sands, alongside gains in the technology sector, contributed to the positive market sentiment. However, the Consumer Staples and Real Estate sectors within SPY's holdings saw declines.

Market Snapshot

- SPY 5-day net outflows: $699 million

- SPY 3-month average trading volume: 73.68 million shares

- Hedge fund managers increased SPY holdings in the last quarter.

- SPY ETF Smart Score: 8 (implies outperformance)

Looking ahead, upcoming economic reports, such as Friday's CPI report, and the ongoing U.S. government shutdown could introduce volatility to the market. Retail sentiment for SPY remains neutral, while hedge fund managers increased their holdings of the ETF in the last quarter. According to TipRanks' ETF analyst consensus, SPY is rated a 'Moderate Buy' with an implied upside potential of 12.9%.