Microsoft reported earnings that surpassed net-income expectations, yet its shares experienced a notable decline. The tech giant's increased spending on data centers and other AI infrastructure, coupled with a slowdown in its crucial cloud business, led to investor unease.

In premarket trading, Microsoft shares fell by approximately 6%. This reaction highlights investor concerns despite the company's strong overall financial performance, signaling a focus on future growth indicators and expenditure.

Key Takeaways

- Microsoft's net income exceeded expectations.

- Increased spending on AI infrastructure impacted investor sentiment.

- Growth in the cloud business slowed, causing concern.

- Shares dropped by about 6% in premarket trading.

AI Infrastructure Investment Rises

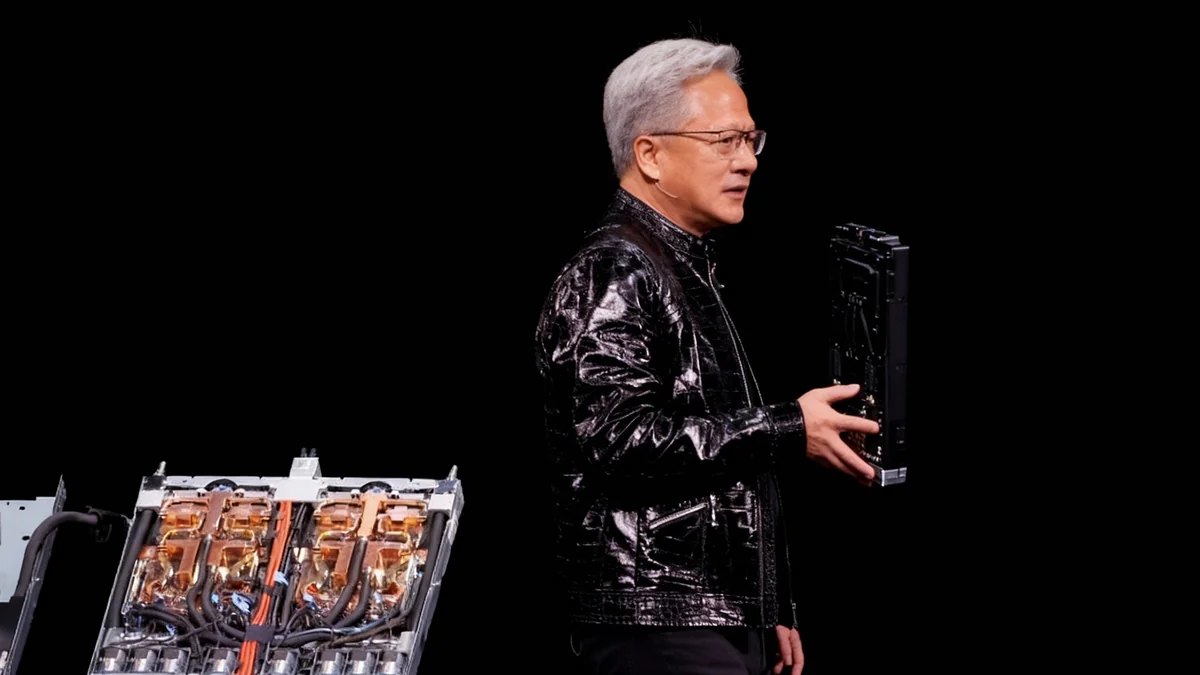

Microsoft has significantly increased its investment in artificial intelligence infrastructure. This includes substantial spending on data centers, a critical component for supporting advanced AI operations and cloud services.

The company's commitment to AI development is clear. However, the scale of these investments appears to have surprised some market analysts and investors. This spending is a strategic move to maintain a competitive edge in the rapidly evolving AI landscape.

While essential for future innovation, the immediate financial outlay raised questions about short-term profitability. Investors often weigh immediate costs against long-term gains, and in this instance, the costs seemed to overshadow the positive earnings report.

Fact Check

Microsoft's investment in AI infrastructure is a key factor in its long-term strategy to dominate the artificial intelligence market. Data centers are foundational to this expansion.

Cloud Business Growth Moderates

The growth rate of Microsoft's closely watched cloud business experienced a slowdown. This segment has been a major driver of the company's revenue and market valuation in recent years.

Analysts pay close attention to cloud performance as it reflects the company's ability to scale its services and attract enterprise clients. A deceleration in this area can trigger investor caution.

The cloud division encompasses a wide range of services, including Azure, which competes directly with other major providers. Sustained high growth in this sector is crucial for Microsoft's overall financial narrative.

"The market is clearly reacting to the higher-than-expected spending on AI infrastructure and the moderated growth in cloud services. Investors are looking for strong signals of future profitability alongside strategic investments."

Investor Reaction and Market Performance

Following the earnings announcement, Microsoft's shares fell approximately 6% in premarket trading. This sharp decline indicates that while net income was strong, other factors weighed heavily on investor sentiment.

The market often reacts sensitively to signs of increased operational costs, even when these costs are strategic investments. The balance between aggressive expansion and maintaining profit margins is a constant evaluation point for investors.

Share price movements reflect collective investor confidence in a company's future prospects. A dip like this suggests that the market is recalibrating its expectations based on the latest financial disclosures.

Market Context

Technology companies, especially those heavily invested in AI, often face scrutiny over their spending. The high capital expenditures required for AI infrastructure can impact short-term earnings, even if they promise long-term returns.

Strategic Implications for Microsoft

Microsoft's decision to invest heavily in AI infrastructure is a long-term strategic play. The company aims to position itself at the forefront of AI innovation, which requires significant capital expenditure.

These investments are critical for developing new AI products, enhancing existing services, and maintaining a competitive edge against rivals. The future of technology is increasingly tied to AI capabilities, making these expenditures almost mandatory.

The challenge for Microsoft is to communicate the value of these long-term investments to a market that often prioritizes immediate returns. Balancing innovation with investor expectations remains a key corporate objective.

- AI development remains a top priority for Microsoft.

- The company seeks to strengthen its position in the global AI market.

- Strategic investments are designed to ensure future growth and innovation.

Looking Ahead: Future Outlook

The coming quarters will be important for Microsoft to demonstrate the returns on its AI investments. Investors will be watching for signs that the increased spending translates into accelerated cloud growth and new revenue streams.

The company's ability to manage costs while driving innovation will be under continuous scrutiny. Market analysts will look for clarity on how these AI expenditures will impact profitability and growth in the medium to long term.

Microsoft's leadership, under Chief Executive Satya Nadella, has a track record of strategic vision. The current market reaction presents a challenge, but also an opportunity to reaffirm the company's long-term growth trajectory in the AI era.